All Categories

Featured

Table of Contents

If you have an interest in the tax obligation lien repossession process, you need to speak to an attorney so you understand and consider the threats of this kind of investment. - what is tax lien certificate investing

Tax obligation lien sales are one way that cities and counties attempt to recoup a few of the general public dollars they've invested preserving these properties abandoned by private owners. As we'll describe in this post,. As soon as real estate tax are thought about overdue, local governments generally concentrate on giving notification of misbehavior and attempting to accumulate the unpaid amounts from the proprietor.

Nevertheless, this procedure generally takes years. If an owner has actually left and is resistant to pay taxes or preserve the residential or commercial property, the city must spend tax obligation bucks to preserve the property. These costsboarding up the building, trimming overgrown yard and weeds, replying to fire and authorities contacts the residential property, and moreadd up

Proprietors who have actually fallen on difficult times definitely need every effort to maintain them out of delinquency and in their homes. Normally, if the property is uninhabited and deteriorated, we need to think the owner has picked to abandon their rate of interest in the home and that they are "reluctant" to pay (though circumstances previously in the procedure may have required their hand).

Tax Lien Investing Colorado

Take, as an example, a single-family home where the proprietor has actually long considering that left. For years the city government has needed to action in and remove garbage discarded in the lawn, board up the doors and home windows, and react to calls concerning illicit activity on the residential or commercial property. All these solutions cost the city government taxpayer dollars.

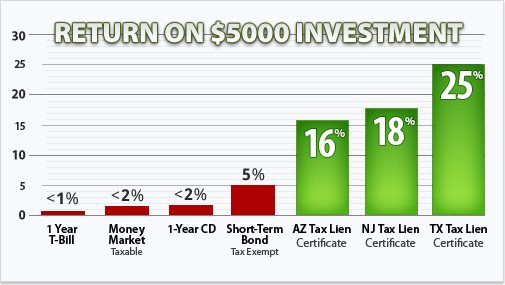

In several states, those costs can be gathered in the exact same fashion as the unsettled tax obligations, but not in all. In a tax lien sale (or tax obligation certification sale) the neighborhood federal government generally holds a public auction where the winning prospective buyer agrees to pay the most money for the right to apply the tax lien, beginning with a minimal quote of at least the taxes had, plus suitable interest, costs, and expenses.

When a government offers the tax lien they are usually offering to a private customer the city government's authority to gather the financial debt for in advance settlement of the tax obligations owed. The customer's purchase generally consists of the capacity to make future rate of interest, as well as recoup relevant fees and expenses incurred by the buyer, if the building owner pays the tax obligation financial debt.

This is, essentially, privatization of a core federal government feature: taxation. Tax obligation lien sales are particularly negative when it pertains to vacant, abandoned, and deteriorated residential or commercial properties since they extend the period before a building can be relocated into the hands of a new, a lot more responsible owner. Personal tax obligation lien customers hold the financial obligation, but they do not own the titlethe lawful right to possession of the propertyand in a lot of cases, they have no interest in obtaining it.

How To Do Tax Lien Investing

Taking into consideration spending plan cuts, city governments in many states have minimized in-house real estate tax collection and enforcement efforts and sought to tax lien sales as a fast infusion of revenue - tax lien investing 101 (tax liens investing). Lots of regions choose or are mandated by the state to offer tax obligation liens because it outsources collection and typically generates extremely needed cash money earlier in the collection procedure

By moving the neighborhood federal government's passion in and enforcement of the tax lien to a personal customer, city governments lose much of their flexibility: flexibility to obtain vacant buildings that the exclusive market doesn't want, or to aid the proprietor prevent shedding their residential or commercial property. With uninhabited residential properties, there is a much greater possibility that the personal purchaser isn't thinking about the residential or commercial property itself.

Tax lien sales can cause damage in historically disinvested areas. In a depressed housing market, less proprietors have the ability to retrieve the quantity of the financial debt sold to a tax lien buyer. These locations are ripe for a different sort of tax lien investorspeculative owners looking for to acquire residential or commercial properties on the economical by foreclosing on the property tax lien, bleeding what little equity is left by leasing an ineffective building to vulnerable occupants, and after that deserting the home when they have actually made back their investment.

Not all state laws provide neighborhood governments the power to intervene in this cycle. Regardless, the building remains vacant and in limbo, all the while imposing substantial expenses on its next-door neighbors and taxpayers. It's easy to understand that several regional governments transform to tax obligation lien sales due to the fact that they aid fund essential civil services.

If the regional government rather offers the building (aka the "tax obligation deed"), as opposed to the tax obligation financial debt, after that they are in control of what happens to the property and the enforcement procedure if the proprietor remains to not pay the real estate tax owed. The government will supply the proprietor a sensible time to pay back the tax obligation financial obligation, after which the federal government will certainly confiscate its rate of interest in the tax obligation lien and the proprietor's right of redemption.

From their creation, these auctions were places for financiers to profit via exploitation. In very early 20th-century cities, well-known "tax sharks" like Chicago's Jacob Glos and New York's Charles Wiltsie generated ton of money by purchasing up scores of tax obligation liens on houses, billing their proprietors inflated total up to remove the lien, or waiting till the due date for settlement passed and asserting the act.

Profit By Investing In Real Estate Tax Liens Pdf

Phone call to eliminate tax lien sales and overhaul tax misbehavior regulations have actually regularly erupted. Usually, they have can be found in feedback to instances of poor, frequently senior property owners that lost their homes to deceitful tax obligation purchasers over tiny tax debts. With a couple of exemptions, state legislatures have stood up to structural reforms (tax lien investing canada).

Those who have actually settled their home loans (primarily seniors or persons that had actually acquired a household home) must also discover the cash to pay real estate tax. This describes why 70 percent of the homes sold at tax obligation lien sales are had outright. It is well past time for states to take on an even more humaneand extra effectivesystem for real estate tax enforcement.

Latest Posts

How To Invest In Tax Lien Certificates

How To Find Tax Foreclosure Properties

Delinquent Taxes Homes For Sale